Innovative Disaster Preparedness, Risk Mitigation Payments Platform Launched to Address Urgent Resource Distribution Challenges

HOUSTON, Texas and MIAMI, Florida | November 5, 2025

Future Proofing America (“FPA”) and Payments As A Lifeline (“PaaL”) have jointly announced an alliance in an integrated financial technology platform for real-time payments distribution, data, tracking, impact reporting, and protections against waste, fraud, and abuse – to transform America’s current public, private, philanthropic resource distribution for people, communities, and small businesses. The Disaster Resilience Fintech Platform (“the Platform”) challenges the status quo by unlocking innovation and investment for ensuring communities are thriving not just surviving from one event to the next.

Both organizations are 501(c)(3)s, committed to driving disaster financial resilience across the U.S. The PaaL coalition brings together the top global fintech companies, and leverages unique fintech capabilities – in payments, data capture, automatic accounting and audit, AI and blockchain —enabling full-cycle transparency in delivery of funds, materials, equipment, and critical resources. The PaaL Fintech Lifeline Hub (“PFLH”) is a central component of the announced nationwide disaster fintech ecosystem.

The alliance between FPA and PaaL represents a dynamic coalition, featuring initial Hub partners from select coalition partners, yet the architecture is designed for agility and expansion, enabling more PaaL partners to take active roles as the platform grows. This ensures broad representation and continual innovation as new challenges and opportunities arise. This evolutionary model empowers any coalition member—present and future—to collaborate and contribute meaningfully to disaster financial resilience and impact.

In alliance with PaaL’s unique industry eco-system, FPA’s Resilience Community Trust – a 501c3 investment vehicle for corporate philanthropy, foundations, donor-advised funders – will engage stakeholders across “Most At Risk/Most In Need” communities with persistent levels of disaster and social vulnerability, thereby addressing more efficiently and effectively regional pre-disaster preparedness and risk mitigation.

Powered by SKUx and its multi-patented core platform capabilities to integrate critical elements of the entire value-chain, from delivery to accounting of funds, materials, equipment, and a broad range of resources – this groundbreaking Fintech Lifeline Hub seeks to strengthen resilience – before during and after disaster. The Hub delivers secure trust and immutable transparency, leveraging SKUx’s leading U.S. focused enterprise blockchain and distributed ledger technology integrations.

The current version of the Hub has already been proven in international and national scenarios for disaster financial relief, recovery, and rebuild. Rebuilding of homes, businesses, communities, and key facilities-infrastructure has often been fragmented and disjointed by competing eligibility rules, confusing missions and timeframes, limited results to consistently track beneficial use of funds.

As the devolution of Federal roles, responsibilities, and resources continues, states and cities will be tasked with allocating and organizing alternative funds to fill the gap. Today’s announcement seeks to accelerate immediate responsive and long-term efficiency at a critical time when budgets, resources, and planning are in transition.

The current Fintech Lifeline Hub features include technical innovation and data integrity:

- Real-time payments and virtual account/card issuance for survivors, small businesses, non-profits, and local responders

- Optional spend guardrails by category, merchant, time, and location – enabling Funders to assure money is spent as intended, and shielding against waste, fraud, abuse, and duplication

- Continuous data collection, feedback loops, and anonymized data analytics for impact reporting

- Blockchain-backed recordkeeping for immutable, transparent data retention, analytics, auditing, forecasting, and compliance

- Ongoing coalition participation: the Hub’s agility enables PaaL coalition partners to play evolving roles, contributing new technical innovations, program leadership, and scale, to keep the Hub at the innovation forefront of disaster resilience.

Kirsten Trusko, Co-Founder of PaaL remarked: “With shifting federal government disaster roles and increasing funding gaps, the need for trusted, data-proven financial aid delivery has never been greater. Organizations in past disasters have said that leveraging the PaaL spend data to confirm funds were spent as intended, has attracted more funding. Our 501c3 coalition’s vision for payments as a true lifeline depends on the combined expertise, agility, and diversity of all of our partners – each having opportunities to lead and serve through the Hub’s evolving structure.”

Richard Seline, Executive Director of Future Proofing America and a Board Member of the Resilience Community Trust stated in Houston today “…there are over $3 trillion of traditional, non-traditional resources seeking to transform the Nation’s risk profile from back-to-back disasters across every geography and sector and yet reviewing every After-Action Report for the past forty years of hurricanes, floods, wildfires, hail storms, we still manage each event anew. Funders, donors, contributors want to know that their community “investments” are not just getting to the right folks but there are driving substantial and measurable changes in risks for their fellow citizens, employees, institutions. Working with PaaL team has been precisely what we have sought to empower a new framework for optimizing all forms of capital!”

Today’s announcement draws upon individual expertise and knowledge, now brought into alignment in light of emerging blockchain, stable coin, digital payments, and more efficient means of directing resources to beneficiaries focused on their immediate wellbeing but disconnected from traditional means of accessing their own resources and lifelines.

Public and academic studies created with private and philanthropic representatives have determined a 1:11 or better cost-benefit for investing ahead of the next disaster – weather, medical, man-made. FPA’s Resilience Data XChange – comprised of over 100+ billion data points at the county, zip code, census tract, and parcel levels coupled with the Fintech Lifeline Hub’s real-time delivery of funds and tracking of impact provides the best in class solution to reduce loss of life and assets while also maintaining the highest of protection against fraud and abuse by nefarious actors.

Joining PaaL and FPA in the announcement is Franciso Sánchez, Jr. – former US Small Business Administrator for Recovery & Resilience and a co-signatory to previous partnership agreements with both PaaL and FPA – stating “…the formation of the Disaster Resilience Fintech Platform is both groundbreaking and necessary as a tool for state and local elected officials, emergency managers, civic and community leaders, funders and foundations who respond when disaster strikes. At the center of a successful and resilient recovery is capital that is quickly deployable, removes barriers to resilience, and protects against bad actors.”

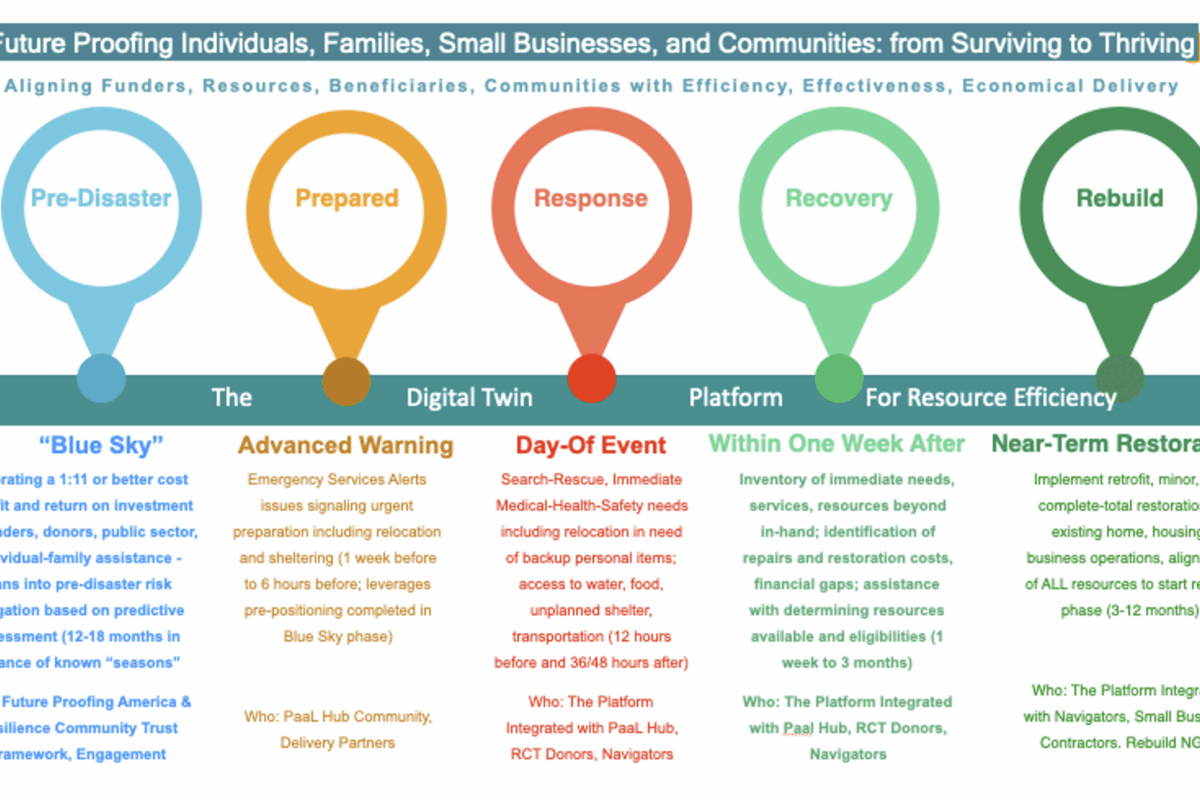

The Fintech Lifeline Hub serves as a so-called “digital twin” by design in identifying every step of resource allocation – from pre-disaster to rebuild – and “mirroring” what are the necessary steps for communities to become thriving locations because of higher values in resilience investment – resource allocation. Across the PaaL and Future Proofing America ecosystems, prior forums, conferences, webinars, townhalls, hundreds of key decision-makers have engaged seeking to transform the Nation’s capacity to respond, recover, and rebuild. The current version of the Hub will be further enhanced in version 2.0 by more powerful blockchain and other advanced technical applications under a “Commons Agreement” enjoining PaaL Hub and the Resilience Community Trust’s Resilience Community Navigators Initiative, accessible to all interested parties.

About PaaL

PaaLPay.org is a 501(c)(3) coalition of top global fintechs with the mission of: delivering disaster financial aid to the right person, right time, right purpose, with the data to prove it. PaaL partners often collaborate on disaster and aid funding programs, as with the PaaL Fintech Lifeline Hub. The PaaL Advisory Council is comprised of leaders from the top federal/state/local governments, non-profits, foundations, corporates – across the US and internationally.

About FPA, Resilience Community Trust, ROAR Partners

Future Proofing America and its Resilience Community Trust unite philanthropy, data, and innovation to enhance national preparedness and recovery. Through close partnership with PaaL and the Hub, the Trust assures responsive, targeted disaster assistance for those most at risk and most in need – the 4000 census tracts designated originally by FEMA and a Whole of Government partnership. FPA and ROAR are a ‘think tank-do tank’ collaboration managed by former CEOs and senior executives of insurance-reinsurance, mortgage, real estate, rating agency, engineering, construction – representative of key stakeholders with enlightened self-interests in transforming the Nation’s risk exposure, preparedness, mitigation.

About the Fintech Lifeline Hub, powered by SKUx

The Fintech Lifeline Hub enables end-to-end humanitarian aid disbursement program management, from onboarding, to distribution, to acceptance and reporting – providing the Disaster and Aid communities’ first standardized recovery platform process. With mobile phones, qr codes, virtual cards, and app-based payments now ubiquitous tools of commerce, the Fintech Lifeline Hub is enabling seamless and impactful financial aid distribution at the point of need. This aid can be delivered to recipients in under 30 seconds directly to their mobile wallet with terms set by funders and powered by SKUx’s multi-patented payments platform and distributed ledger technology integrations. For more information, visit skux.io.

For additional information on today’s announcement:

PaaL email and phone: support@PaaLPay.org, (202) 964-0522

FPA email and phone: rseline@futureproofingamerica.org, (703) 608-3000